1. Introductory remarks

1.1 These provision of services Regulations (hereinafter referred to as the “Regulations”) determine the procedure and conditions under which AMARKETS LLC. (hereinafter referred to as the “Company”) performs and ensures the handling of trading transactions in the international financial market with the Clients – individuals who have opened an ECN, Standard Market, Standard, Fixed or Crypto trading account with the Company (hereinafter referred to as «Clients»).

1.2 These Regulations define:

a) principles of opening/closing positions and placing/modifying/deleting/executing orders;

b) the Company’s actions in respect to the Client’s open positions if the Margin Level on the trading account should be insufficient to support such open positions;

c) procedures of dispute resolution and methods of communication and information exchange between the Client and the Company.

1.3 All the terms and conditions that govern the Client’s trading operations are described in these Regulations, the Customer Agreement and the Risk Disclosure documents and any other applicable documents which can be found in the “Documents” section on the Company’s Website.

1.4 These Regulations are an integral part of the public offer placed by the Company on its website fr.amarkets.com and should be considered by all interested parties as an offer to conclude a «Customer Agreement» (hereinafter referred to as the «Agreement»), on the terms contained in Agreement and Regulatory Documents.

1.5 Acceptance of an offer by any legally capable person shall imply acceptance of the terms and conditions described in these Regulations. By signing this document, the Client confirms that he is not a US and EU resident.

1.6 In respect of the Client, the Company undertakes to conclude and execute conversion transactions on terms and in the manner described in these Regulations.

1.7 Paragraph 9 («Terms and definitions») provides the definitions of terms. In the event of any conflict, contradiction or inconsistency between the terms and definitions of these Regulations and the Customer Agreement, the definitions described in the Customer Agreement shall prevail.

2. General principles

Quotes

2.1 The Company obtains quotes for all trading instruments in real time, based on market conditions and streaming prices/liquidity received from liquidity providers, and periodically provides these quotes to the Client in the form of Market snapshots.

2.2 All quotes that the Client receives through the Client Terminal are indicative and are the best available Bid and Ask prices that are received from the Liquidity Providers.

2.3 Depending on the group and trading conditions, trading instruments are displayed with a suffix at the end of the symbol. The Client undertakes to perform trading operations in the MetaTrader 4 platform using only trading instruments with suffixes. Instruments which are not available for trading shall be displayed without suffixes for indicative purposes and highlighted in gray in the trading terminal in the Market Watch window. General information on trading instruments provided in the trading terms and conditions and in other sections of the company’s website may be published without suffixes. The Client acknowledges and agrees that the information on the website and in the trading terminal may differ. The Client is notified and aware of the instruments to be used in the trading activity.

2.4 The Client acknowledges that:

a) The Company has the right not to provide to the Customer those quotes that have not changed since the previous market snapshot;

b) The client can see not all the quotes in the quotes flow in the Client Terminal in the period between market snapshots, while the order can be executed at the price, which is not available in the client terminal, but available on the counterparty-server;

c) On Standard Market, ECN and Crypto accounts, spreads are not fixed and can be changed depending on market conditions and streaming quotes/liquidity offered by the liquidity providers.

d) On Standard accounts, most currency trading instruments are available for trading with Instant execution and a floating spread, which can be changed depending on the market conditions and streaming prices/liquidity, received from liquidity providers. Trading of CFD instruments and exotic currency pairs is carried out with a floating spread and Market execution.

e) On Fixed accounts, instant order execution and fixed spread are used on most of the currency instruments, the spread can be changed depending on market conditions and streaming quotes/liquidity offered by the liquidity providers. To CFD instruments and exotic currency pairs, Market execution and floating spreads are applied.

f) On ECN, Standard Market and Crypto accounts, market orders are executed at the prices available in the Market Depth. In the event of insufficient liquidity to execute the order of the requested volume at the first level, the order execution will occur at the next available price levels, until the declared volume is fully filled. When being executed at several levels of Market Depth, the price in the terminal is displayed as a weighted average and may not coincide with quotes, ticks and charts in the trading terminal.

Execution of the Client’s trade requests

2.5 The following algorithm will be used to process client trade requests submitted via the client terminal:

1) The client places an order which is then verified in the client terminal;

2) If the order is correct, the terminal sends it to the server;

3) If the connection between the client terminal and the server is stable, the Client’s order is sent to the server and is checked for correctness;

4) Orders that have passed the check are placed in the execution queue to be processed on the trade server. The orders and their current status are displayed in the «Order» window in the client terminal: «Order is accepted»;

5) When the Company is ready to process the new order, it takes the first order in the execution queue, and the order’s current status is displayed in the «Order» window: «Order is in process»;

6) the result is sent to the server;

7) The server then sends the result of processing the client’s request to the client terminal;

8) in the case of a stable connection between the client terminal and the server, the client terminal receives the result of processing of the client request.

2.6 The client has the right to cancel the trade request or order sent earlier only while the request or order is in the queue and has the status «Order is accepted». To cancel the request, the Client should click the «Cancel order» button. The client cannot cancel the request or order sent by his Expert Advisor.

2.7 The client cannot cancel the request or order sent earlier if the trade request or order has been already accepted by the Company for processing and has the status «Order is in process».

2.8 All matters regarding the current market price are at the sole discretion of the Company.

2.9 The processing time for orders depends on the quality of the connection between the trading platform and the server, as well as the market conditions. In normal market conditions, it usually takes up to 1 second to process the Client’s trade request. In extreme market conditions, the processing time can be increased to 10 seconds, sometimes longer. At the same time, each client request or order placed in the queue has a maximum waiting period within which it must be executed (3 minutes). If a request or order has not been sent to the Dealer within this period of time, the request or the order is removed from the queue as outdated.

2.10 The Dealer has the right to decline the Client’s request or the order in the following cases:

a) if the order or request precedes the first quote in the Trading Platform at the Market Opening;

b) under Abnormal Market Conditions;

c) if the Client’s free margin is insufficient to open a position;

d) if the limit for the overall volume of a Client position and/or the number of orders has been exceeded on this type of account;

e) in the event of force majeure;

f) the request is incorrect, missing the important elements. Such requests are rejected automatically;

g) if the Company cannot hedge the transaction through the liquidity provider;

h) if the Company, due to the situation on the market, is unable to determine the price of the financial instrument;

i) extreme price fluctuations of the underlying instruments;

j) immediately before the release of important economic news or due to important macroeconomic events.

k) if the requested through Instant execution price on Standard or Fixed accounts differs from the market price. In these cases, one of the following messages will appear in the Client Terminal: “Off quotes”; “Invalid prices”; “Cancelled by dealer”; “Not enough money”; “Trade is disabled” or “Reject”.

2.11 The Dealer has the right to deny the Client’s instruction to execute any type of a pending order (i.e. buy limit, sell limit, buy stop, sell stop, take profit and stop loss) in cases specified in paragraph 2.10 of these Regulations. In these cases, there will be no corresponding entry in the Server log-file, while the pending order will remain active and can be executed next time when the price reaches the level set in the pending order.

2.12 The Client’s orders are considered processed and trading operations performed after the corresponding entry appears in the Server Log File.

2.13 The Customer agrees that all requests sent via the Personal Area or other products of the Company can be processed within 24 hours after submission. In some cases, the processing time may be increased.

2.14 The Company has the right at its discretion to change the type of the Client’s account and/or or refuse to open additional trading accounts for the Client in accordance with its own risk management rules. In doing so, the Company shall endeavor to notify the Client of the changes by all the means of communication available.

Trading operations

2.15 Buying is executed at the demand price (Ask), and selling is performed at the supply price (Bid).

a) The opening of a long position is executed at the Ask price. The opening of a short position takes place at the Bid price.

b) Closing a long position (i.e sell) is performed at a Bid price. Closing a short position (i.e buy) is executed at the Ask price.

2.16 In the period 23:58–00:10 (EET Eastern European Summer Time UTC +3) and 22:58–23:10 (EET Eastern European Time UTC +2) server time, all trading operations including opening/closing positions, as well as removal/modification/placement of orders can be temporarily unavailable due to reboot of trading servers. The Client acknowledges that the Company shall not accept any claims regarding the failure to perform any trading actions in the specified period of time.

2.17 The Company has the right to transfer the Client’s trading instrument(s) to the «close only» mode at any time without prior notice. The Client acknowledges that the Company shall not accept any claims arising out of the failure to perform any trading operations as a result of a restricted trading mode.

2.18 In the event of a large number of requests (incorrect trade requests for placing or modifying orders, other non-trading commands) that create a load on the trading server, the Company has the right to block the Client’s trading account without prior notice. In doing so, the Company will endeavor to notify the Client of the changes by all the means of communication available.

Rollover

2.19 The rollover begins at 23:59:45 server time and is mandatory for all positions that remained open between 23:59:45 and 23:59:59 server time. Positions will be rolled over to the next trading by deducting or crediting a storage fee (swap) from/ to the Client’s trading account according to the swap rates, found in the “Trading instruments” section on the company’s website. From Wednesday to Thursday swaps for most currency instruments, metals and Stocks CFDs are charged at a triple rate, for three calendar days from Friday (settlement date for transactions made on Wednesday) to Monday (settlement date for transactions made on Thursday). For cryptocurrencies CFDs, a triple swap is charged on Friday. More detailed information can be found in the specification of each instrument in the trading platform. If a settlement date for a triple swap falls on a public holiday in the country of one of the two currencies in the pair, the triple swap may be charged on another day of the week and cover more days. The holiday calendar is published on the company’s website. The Company reserves the right to change the swap rates for current/newly opened positions from the next day after the change. Information on the current trading terms and conditions can be found in the “Trading instruments” section on the Company’s website.

Expiration

2.20 The MetaTrader 4 platform uses a mechanism that adjusts points at the time of delivery of the corresponding basic instrument. This mechanism is a technical adjustment of the instrument’s price for a special rate and is used to clear the price of the underlying instrument from all non-market factors associated with the change of its delivery date. Open positions remain intact. Such Adjustment during delivery is recorded in the «Swap» column in the MetaTrader 4 trading platform. The client acknowledges that technical adjustment can result in a negative account balance and trigger a Stop Out (a forced closure of positions). Relevant information on the adjusted points is published in the “Rollovers” section on the Company’s website at the end of the trading session of an asset. Information on expiration dates is specified in the “Expiration Calendar” on the Company’s website.

Split

2.21 A stock split is an action in which a company divides its existing shares into multiple shares. After a split, the stock price will be proportionately reduced. Reverse stock splits (split consolidation) are the opposite transaction, where a company divides, instead of multiplies, the number of shares that stockholders own, raising the market price accordingly. The Client agrees that in the event of a split or a reverse split in any trading instrument, all open positions held on the split date will be forcibly closed with the commentary “Split”. The Сlient also agrees that in the event of a split or a reverse split in any trading instrument, all pending orders will be permanently deleted. Up-to-date information about the upcoming split/split consolidation and its ratio is published on the Company’s website in the “Company News” section weekly.

Dividends

2.22 A dividend is a payment made by a corporation to its shareholders as a distribution of profits, in accordance with the number of shares held. The Client agrees that if he has open positions in a particular share on the ex-dividend date, the amount equal to the dividend value of the trading instrument will be credited or deducted to/from the trading account in the “Swap” column. The amount of accrual/deduction will be calculated by the formula: Position volume in lots * contract size * dividend amount. The Client also acknowledges that if he has a BUY position, dividends will be credited to the trading account, and if he has an open SELL position, dividends will be written off. Relevant information about the dividend accrual dates is published on the Company’s website in the “Company News” section weekly.

Quotes Base synchronization

2.23 In the event of interruptions in the quotes flow on the server caused by some hardware and/or software failure, the Company is entitled to synchronize the live server’s quotes base with other sources. Such sources can be:

a) demo server’s quotes base;

b) any other quotes sources.

All disputes arising as a result of the quotes flow interruption shall be solved based on the synchronized quotes base. In the event of any controversial situations regarding the interruption in the flow of quotations, all decisions are made in accordance with the synchronized quotation base.

Leverage

2.24 The Company provides the opportunity to perform trading operations using the maximum leverage of 1:3000 on ECN, Standard Market, Standard and Fixed accounts and using the maximum leverage of 1:500 on Crypto accounts. This means that the maximum amount of all open positions (in monetary terms) may exceed the current balance in the Client’s account by no more than 3000 times with the leverage of 1:3000. In some cases, the leverage may be exceeded.

2.25 The maximum leverage ratio of 1:3000 applies to currency pairs and metals, except for those with fixed leverage. To activate 1:2000 or 1:3000 leverage, the Client must complete the following requirements:

– at least 10 orders must be closed on currency pairs and metals (pending orders are not taken into account) with a total volume of 5 lots or more across all live accounts in the Client’s Personal Area.

2.26 The leverage ratio varies depending on the account’s equity level in accordance with the current trading conditions.

2.27 If the account equity drops below the threshold, the leverage ratio will automatically increase to the previous thresholds. If, after the funds dropped below the threshold value, the leverage ratio wasn’t adjusted to the previous threshold value automatically, the Client can change it manually in his Personal Area. The Client acknowledges that the Company will not accept any claims related to the untimely change in the leverage ratio.

2.28 From 10:00 PM (EET) Friday to 1:00 AM (EET) Monday of MetaTrader 4 and MetaTrader 5 server time, the increased leverage will be applied as follows:

a) The increased leverage is automatically decreased to 1:1000.

b) AMarkets’ clients won’t be able to make any changes to the leverage during these hours.

c) AMarkets’ clients are not allowed to register new trading accounts with the increased leverage during this period of time.

d) After Monday 01:00 AM (EET), the leverage size will be restored to the previous value.

2.29 The Client acknowledges that a decrease in the leverage ratio from the threshold value to 1:1000 between Friday 22:00 (EET) and Monday 01:00 (EET) may trigger a Stop Out (a forced closure of all positions).

2.29.1 The Company reserves the right to change the time interval for changing the leverage without prior notice to the Client.

2.30 AMarkets may:

a) Limit the maximum account leverage to 1:200 for all positions opened within 15 minutes before and 10 minutes after the release of significant macroeconomic news, provided that the account leverage currently exceeds 1:200.

Calculation Examples:

Scenario 1

20 minutes before the publication of important macroeconomic news, position #1 (0.1 lot USD/JPY) is opened on an account with a leverage ratio of 1:2000. The margin required for this position is $5.

6 minutes later, position #2 is opened with a similar volume of 0.1 lot. Due to the increased volatility during the news period, the margin required for position #2 is $50.

Thus, the total margin for both positions is $5 (for position #1) + $50 (for position #2) = $55.

10 minutes after the publication of the news, the margin requirements for position #2 are recalculated, reducing the margin to $5. Consequently, the total margin for both positions is now $5 (for position #1) + $5 (for position #2) = $10.

Scenario 2

20 minutes before the publication of important macroeconomic news, position #1 (a buy position) and position #2 (a sell position) are opened on an account with a leverage ratio of 1:2000. Both positions have a volume of 0.1 lot (USD/JPY). The total margin required for these positions combined is $5.

6 minutes later, position #1 is closed. The margin requirements are then recalculated, resulting in an increase of the margin for position #2 to $50 due to the heightened volatility during the news period.

10 minutes after the publication of the news, the margin requirements are recalculated again, reducing the margin for position #2 to $5.

b) Limit the maximum leverage offered and/or increase margin requirements before the publication of important macroeconomic news or any other news that could significantly impact financial instrument prices.

2.31 In case of any changes of leverage on the trading account, all margin parameters in your trading terminal will be displayed according to the previous leverage settings until you re-login to your MetaTrader 4 or MetaTrader 5 trading terminals. We recommend you to re-login to your trading terminal each time you make changes to the leverage, so that all margin parameters are displayed correctly.

2.32 The client is notified that the use of leverage is associated with a high level of risk and may result in a partial or total deposit losses.

2.33 The Company reserves the right to change its margin requirements on new positions and on positions that are already open at any time without prior notice to a Client.

2.34 The Company reserves the right, at its sole discretion, to change the leverage ratio on the Client’s account at any time. At the same time, the Company will strive to notify the Client in advance of any changes through all the available communication channels.

2.35 The amount of leverage may be tied to the total assets in the Client’s accounts.

2.36 When opening each new position, the Client may set the actual amount of the leverage, by choosing the trade volume (in lots). The following will apply: the larger the volume of the open position, the higher the leverage, provided that the equity level at the moment of placing an order is the same, and the leverage itself is actually used.

2.37 To calculate the acceptable volume for each subsequent position correctly, the Client should possess knowledge about his total volume of all open positions and the balance of funds in his account, taking into account unrealized loss and profit on current positions.

Margin

2.38 The Client undertakes to deposit and maintain the initial margin and/or hedged margin in the amount required by the Company under this Agreement, the relevant Regulations and margin requirements set out in the Trading Instruments. Margin should be transferred to the Company’s bank account in the form of unencumbered funds.

2.39 The Client shall pay the initial margin and/or hedged margin when opening the position. The amount of the initial margin and hedged margin for each instrument is specified in the “Trading Instruments” section on the Company’s website.

2.40 The Company may at any time at its sole discretion change the amount of the initial, required or hedged margin:

a) for all Clients, with 7-day (seven) notice;

b) for a particular Client, to adjust the leverage in accordance with the margin requirements specified on the Company’s website in the “Trading Instruments” section;

c) for a particular Client in the event of an emergency, without prior notification;

d) or all Clients in the event of force majeure circumstances, without prior notification.

2.41 The Client shall be responsible for maintaining the necessary margin level on the trading account.

2.42 The Company is entitled to apply clause 2.39 both in relation to existing positions and in relation to the recently opened positions.

2.43 The Company doesn’t charge margin for opening an opposite position of the same volume on one financial instrument in the MetaTrader 4 platform, but the total margin may change if the weighted average exchange rate has changed after the opposite position was opened. When opening an opposite position the margin is calculated as follows. Suppose, the Client placed three orders: buy 1.00 EUR/USD at 1.48354; buy 1.50 EUR/USD at 1.48349; sell 0.80 EUR/USD at 1.48319.

1) The weighted average opening price is calculated. It will be used to calculate the margin. Wa = (1.00 * 1.48354 + 1.50 * 1.48349 + 0.80 * 1.48319) / (1.00 + 1.50 + 0.80) = 1.4834324.

2) The margin for the hedged volume is calculated. In this case, the hedged volume is 0.8 lot. The margin is calculated for buy order 0.8 and sell order 0.8, so, the total volume equals 0.8 * 2 = 1.6. Hedged_margin = (1.4834324*1.60*50 000)/100 = 1186.745939.

3) The margin value for the unhedged volume is calculated. The unhedged volume in our example will be 1.00 + 1.50 – 0.80 = 1.70. Unhedged margin = (1.4834324*1.70*100 000)/100 = 2521.83508.

4) The final margin is calculated – the sum of the two previous values. Margin = Hedged margin + Unhedged margin = 2521.83508 + 1186.745939 = 3708.58.

2.44 There is no strict verification of margin requirements when opening a hedging position in the MetaTrader 4 platform. This means that the opening of a hedging position is permitted if the free margin doesn’t become negative after the position is opened or the margin requirements after the opening of the hedging position are reduced.

Commission and other costs

2.45 The Client undertakes to pay commission and other fees charged by the Company in accordance with the rates specified in the «Trading Conditions» section on the Company’s website.

2.46 The Company reserves the right to change its commission and other fees at its sole discretion without prior written notice to the Client. All changes are published on the Company’s website.

2.47 Acting in compliance with all applicable rules and regulations, the Company is not obliged to disclose or provide any reports to the Client in respect of revenues, commissions and other fees received by the Company in respect of the Client’s trading operation, except as otherwise expressly provided in this Agreement or the relevant Regulations.

2.48 The Client’s financial result (unrealized profit or loss) on open positions is calculated automatically with each change in quotations for each open position. Calculation of the current financial result for a particular position is performed according to the formulas described in the Trading Conditions on the Company’s website.

Archiving inactive trading accounts

2.49 A trading account will be automatically archived if:

– the trading account was dormant in the last 60 days (the account showed no trading or other types of activity);

– the account balance is 0 dollars;

– there are no open positions on the account.

2.50 The Company has the right to archive the Client’s trading account, which has funds but has been inactive (no trading and non-trading transactions) for more than 60 days. The funds will be automatically transferred to the Client’s wallet and will be available in the Personal area.

Archiving trading history

2.51 The Company may archive the history of trading transactions older than 2 months (including canceled pending orders). After the trading history is archived, it will no longer be available for viewing in the trading platform. The financial result of the archived positions will be displayed in the “Account history” of the MT4 trading platform as a single balance or trading operation with the comment “History compression”.

For example, in 2021, a client closed one trade with a financial result of -$90, and in 2022 closed another trade with a $360 profit. After archiving, those trades will disappear, and instead, one balance or trading operation (Balance or Buy) for $270 with the comment “History compression” will be displayed.

3. Opening a position

3.1 The Client shall specify the following parameters when placing an order to open a position:

a) instrument;

b) transaction size (volume).

3.2 To open a position in the сlient terminal without using an Expert Advisor:

а) on ECN, Standard Market, and Crypto accounts with “Market Execution”, the Client shall send a request by pressing the “Buy by market” or “Sell by market” button. The Сlient’s order to open a position can be executed at a price different from the price quote displayed in the client terminal during the last market snapshot. Sending a market order in this mode implies that the Client agrees with the price quote at the moment of execution in advance. In any case, the Company seeks to execute such orders at the best available prices through the Company’s liquidity providers.

b) on Standard and Fixed accounts with “Instant Execution”, the Client shall send a request by pressing the “Buy” or “Sell” button. The Сlient’s order to open a position will be executed at the requested price if it matches the price quote displayed in the client terminal during the last market snapshot. In cases when the market price changes during the execution of an order, the trader will see the “Requote” or “Off quotes” message. If, after the “Requote” message appears, the Client agrees to execute the order at a new price, he must confirm the order within 3 (three) seconds by pressing the “Ok” button. Otherwise, the instruction to execute an order will be canceled. When the “Ok” button is pressed, the instruction to execute the order at a new price is sent to the trading server again. If the “Off quotes” message appears, the Client must close the order window and request a price quote again.

3.3 If the position is opened via the Client terminal using the Expert Advisor, the Client cannot preset the Stop loss and / or Take profit levels. If the Client wishes to place such orders, he can do so by modifying the existing position in accordance with paragraphs 6.15-6.21.

Processing and execution of requests to open a position

3.4 When the Server receives the Client’s request to open a position, it automatically checks whether the free margin in the trading account is sufficient to open the position: the Client’s aggregate position and the new necessary margin («New margin») for the locked positions (Matched positions) is determined, depending on the hedge margin. For other positions – depending on the initial margin, which is calculated according to the weighted average price (by the volume) for all positions, except for the locked ones;

a) Floating Profits/Losses on all open positions are calculated at the current market prices;

b) «Free margin» is calculated by the formula: Free margin = Balance — New margin + Floating profit / Floating loss;

c) If the above calculations are made and the «Free margin» is greater than zero for the amount of maintaining the initial margin and / or hedged margin, the position will be opened. The opening of the position will be accompanied by a corresponding entry in the Server log file. If the «Free Margin» is less than zero, the Company reserves the right to reject the request to open the position, while the corresponding «No money» entry will appear in the Server log file.

3.5 The Client’s order to open a position should be deemed executed and the position opened once the corresponding record appears in the Server log file.

3.6 Each open position in the trading platform is assigned a ticket.

3.7 The Company shall decline the Client’s request to open a position if such request precedes the first quote in the Trading Platform at Market Opening. In this case, the «Off quotes» message will appear in the Client Terminal.

4. Closing a position

4.1 The Client shall specify the following parameters when placing an order to close a position:

a) ticket;

b) transaction size.

4.2 To close a position via the Client Terminal without using an Expert Advisor, the Client shall send the request by pressing the «Close…» button. The Сlient’s order to close a position:

a) On ECN, Standard Market and Crypto accounts, can be executed at a price different from the quote the Client received in the Client terminal during the last Market snapshot. Sending a market order in this mode implies that the Client agrees with the actual quote at the moment of execution in advance. In any case, the Company seeks to execute such orders at the best available prices through the Company’s liquidity providers.

b) On Standard and Fixed accounts, can be executed at a price different from the quote the Client received in the Client terminal during the last Market snapshot. Sending a market order in this mode implies that the Client agrees with the actual quote at the moment of execution in advance. In any case, the Company seeks to execute such orders at the best available prices through the Company’s liquidity providers.

Processing and execution of requests to close a position

4.3 If the list of open positions on a trading account contains two or more locked positions, then once the request to close one of them has been generated, the additional “Close By” option will appear in the “Type” drop-down list. If the Client chooses this option, a list of opposite open position(s) will appear. By pressing the “Close by” button, the Client closes locked positions of the same volume or partially closes two locked positions of different volumes. The smaller position and equivalent part of the larger position will be closed, and a new open position will be generated in the same direction as the larger position and assigned with a new ticket.

4.4 If the list of open positions on a trading account contains two or more locked positions, then once a request to close one of them has been generated, the additional “Multiple Close By” option will appear in the “Type” drop-down list. If the Client chooses this option by pressing the “Multiple Close By” button, the Client closes all locked positions and a new open position will be generated in the same direction as the larger total volume and assigned with a new ticket.

4.5 The Client’s order to close a position should be deemed executed and the position closed once the corresponding record appears in the Server log file.

4.6 The Company shall decline the Client’s request to close a position if such request precedes the first quote in the Trading Platform at Market Opening. In this case, the «Off quotes» message will appear in the Client Terminal.

4.7 The Company shall decline the Client’s request to close a position if such request was made when the order («StopLoss» or «TakeProfit») is in the queue to be executed. In this case, the «Off quotes» message will appear in the Client Terminal.

5. Telephone dealing

5.1 In cases where, due to various reasons, the Client cannot open / close a position or place / delete / modify an order directly in the trading platform, the Company offers the service of telephone dealing. The Client can perform the above mentioned actions by phone +44 20 380 869 68.

5.2 The execution of trade operations by phone shall be performed only after the Client is verified by the Dealer. When contacting the Dealer, the Client must verify his identity by specifying his trading account number and the telephone password.

5.3 A transaction performed over the phone shall be deemed executed if:

a) the Client completed the verification procedure as described in clause 5.2 before requesting to perform the transaction;

b) the Client clearly formulated purpose of the trade operation – place / delete / modify an order, open / close a position indicating the instrument and the transaction volume;

с) the Dealer repeated the details of the transaction aloud after the Client;

d) the Client gave his consent to perform the transaction immediately after the Dealer reiterated the details of the transaction.

5.4 The client can check his trading account status and the current price for any traded instrument.

6. Orders

Types of orders in the trading platform

6.1 The following types of pending orders to open a position may be placed in the trading platform:

a) «Buy stop» — an order to open a long position at a price higher than the price at the time the order is placed;

b) «Sell stop» — an order to open a short position at a price lower than the price at the time the order is placed;

c) «Buy limit» — an order to open a long position at a price lower than the price at the time the order is placed;

d) «Sell limit» — an order to open a short position at a price higher than the price at the time the order is placed.

6.2 The following orders can be used to close a position:

a) «Stop loss» — closing a position at a price that is less profitable for the Client than the price at the moment of placing the order;

b) «Take profit» — closing a position at a price more profitable for the Client than the price at the time of placing the order;

c) «If done» — «Stop loss» and / or «Take profit» orders, which are activated only after the execution of the pending order which they are linked to.

Order timing and duration

6.3 The Client may only place, modify or delete orders within the trading hours for the particular instrument. The trading hours for each instrument are specified in the “Contract Specifications” section in trading platform.

6.4 All pending orders have “GTC” (“Good till cancelled”) status. The Client can set an exact expiry date and time in the “Expiry” field; otherwise, the order will be executed after an indefinite period.

6.4.1 The Company reserves the right to delete pending orders on a Client’s trading account without prior notice if they were placed more than 90 days ago.

6.5 Stop Loss and Take Profit orders on all instruments have “GTC” status (“Good till cancelled”) and are placed for an indefinite period.

Procedure for placing orders

6.6 When sending a request to place a Pending order, the Client shall specify the following required parameters:

a) instrument;

b) transaction size;

c) order type (Buy Stop, Buy Limit, Sell Stop, Sell Limit);

d) order level.

The Client may also set the following optional parameters:

a) Stop Loss level. “0.0000” means that Stop Loss hasn’t been placed (or has been deleted if it was placed earlier);

b) Take Profit level. “0.0000” means that Take Profit hasn’t been placed (or has been deleted if it was placed earlier);c) Pending order expiry date and time.

The request will be declined if:

a) one or several required parameters are not specified or incorrect;

b) one or several optional parameters are incorrect. In this case, if the orders are placed via the Client Terminal without using an Expert Advisor, the “Invalid S/L or T/P” error message will appear.

6.7 When sending a request to place a «Stop loss» or a «Take profit» order, the Client shall specify the following parameters:

a) Ticket of the open position for which these orders are placed;

b) Stop Loss level. “0.0000” means that Stop Loss hasn’t been placed (or has been deleted if it was placed earlier);

c) Take Profit level. “0.0000” means that Take Profit hasn’t been placed (or has been deleted if it was placed earlier).

If one or several parameters are incorrect when placing a Pending Order via the Client Terminal without using an Expert Advisor, the request will be declined and the “Modify…” button will remain inactive.

6.8 When sending a request to place If-Done orders on a Pending Order, the Client shall specify the following parameters:

a) ticket of the Pending Order for which the If-Done orders are placed;

b) Stop Loss level. “0.0000” means that a Stop Loss hasn’t been placed (or has been deleted if it was placed earlier);

c) Take Profit level. “0.0000” means that a Take Profit hasn’t been placed (or has been deleted if it was placed earlier).

If one or several parameters are incorrect when placing a Pending Order via the Client Terminal without using an Expert Advisor, the instruction will be declined and the “Modify…” button will remain inactive.

6.9 When sending a request to place Stop Loss and/or Take Profit orders on an open position or Pending Order, the difference in pips between the Pending Order level and the current market price must be no less than the number of pips indicated in the Contract Specifications for each instrument, and the following conditions must be satisfied:

a) for a Stop Loss order on a short position the current market price is considered the Ask price and the order must be placed no lower than the Ask price plus the number of pips set for this instrument;

b) for a Take Profit order on a short position the current market price is considered the Ask price and the order must be placed no higher than the Ask price minus the number of pips set for this instrument;

c) for a Stop Loss order on a long position the current market price is considered the Bid price and the order must be placed no higher than the Bid price minus the number of pips set for this instrument;

d) for a Take Profit order on a long position the current market price is considered the Bid price and the order must be placed no lower than the Bid price plus the number of pips set for this instrument;

e) for a Buy Limit order the current market price is considered the Ask price and the order must be placed no higher than the Ask price minus the number of pips set for this instrument;

f) for a Buy Stop order the current market price is considered the Ask price and the order must be placed no lower than the Ask price plus the number of pips set for this instrument;

g) for a Sell Limit order the current market price is considered the Bid price and the order must be placed no lower than the Bid price plus the number of pips set for this instrument;

h) for a Sell Stop order the current market price is considered the Bid price and the order must be placed no higher than the Bid price minus the number of pips set for this instrument.

6.10 When sending a request to place an If-Done Order on a Pending Order, the Clients has to be aware that the difference in pips between the If-Done Order Level and the Pending Order level must be no less than the number of pips indicated in the Contract Specifications for each instrument, and the following conditions must be satisfied:

a) a Stop Loss order on a Buy limit or Buy stop pending order must be placed no higher than the level of the Pending Order minus the number of pips set for this instrument;

b) a Stop Loss order on a Sell limit or Sell stop pending order must be placed no lower than the level of the Pending Order plus the number of pips set for this instrument;

c) a Take Profit order on a Buy limit or Buy stop pending order must be placed no lower than the level of the Pending Order plus the number of pips set for this instrument;

d) a Take Profit order on a Sell limit or a Sell stop pending order must be placed no higher than the level of the Pending Order minus the number of pips set for this instrument.

6.11 A request to place an order shall be deemed executed and the order shall be deemed placed when the corresponding record appears in the Server Log File.

6.12 Each pending order is assigned with a ticket.

6.13 The Company shall decline the Client’s request to place an order if such request precedes the first quote in the Trading Platform at Market Opening. In this case, the «Off quotes» message will appear in the Client Terminal.

6.14 The Company reserves the right to decline a request to place an order is, while processing this request, the current quote reaches a level at which at least one of the conditions described in clauses 6.10 and 6.11 is breached.

Order Modification and Removal

6.15 To send a request to modify Pending Order parameters (the level of the Pending Order and/or If-Done Orders), the following parameters should be specified:

a) ticket;

b) Pending Order level;

c) Stop Loss order level; 0.0000 shall mean that a «Stop loss» order hasn’t been placed (or has been deleted if it was placed earlier);

d) Take Profit order level; 0.0000 shall mean «Take profit» order hasn’t been placed (or has been deleted if it was placed earlier).

If any of the parameters is incorrect when placing/modifying/deleting an order via the Client Terminal without using an Expert Advisor, the request will be declined and the “Modify…” button will remain inactive.

6.16 To send a request to modify Stop Loss and Take Profit orders on an open position the following parameters should be specified:

a) Ticket;

b) Stop Loss level;

c) Take Profit level. If one or several parameters are incorrect when placing/modifying/deleting orders via the Client Terminal without using an Expert Advisor, the request will be declined and the “Modify…” button will remain inactive.

6.17 When sending a request to delete a Pending Order, the Client shall specify its ticket.

6.18 The request to modify or delete an order shall be deemed executed and the order shall be deemed modified or deleted when the corresponding record appears in the Server Log File.

6.19 The Company shall reject the Client’s request to modify or delete an order if such request precedes the first quote in the Trading Platform at Market Opening. In this case, the «Off quotes» message will appear in the Client Terminal.

6.20 The Company reserves the right to decline a request to modify or delete an order should, while being processed, the order will be placed in the queue to be executed in accordance with clause.

6.21 Should the processing of a request to modify or delete an order be completed only after the order is placed in the queue to be executed in accordance with clause 6.22, the Company reserves the right to cancel the modification or removal of the order.

Order Execution

6.22 The order will be placed in the queue to be executed in the following cases:

a) a Take Profit on an open long position is placed in the queue to be executed if the Bid price in the quotes flow becomes equal to or higher than the order level;

b) a Stop Loss on an open long position is placed in the queue to be executed if the Bid price in the quotes flow becomes equal to or lower than the order level;

c) a Take Profit on an open short position is placed in the queue to be executed if the Ask price in the quotes flow becomes equal to or lower than the order level;

d) a Stop Loss on an open short position is placed in the queue to be executed if the Ask price in the quotes flow becomes equal to or higher than the order level;

e) a Buy Limit is placed in the queue to be executed if the Ask price in the quotes flow becomes equal to or lower than the order level;

f) a Sell Limit is placed in the queue to be executed if the Bid price in the quotes flow becomes equal to or higher than the order level;

g) a Buy Stop is placed in the queue to be executed if the Ask price in the quotes flow becomes equal to or higher than the order level;

h) a Sell Stop is placed in the queue to be executed if the Bid price in the quotes flow becomes equal to or lower than the order level.

6.23 Once a request to place a pending order is sent, the Server automatically checks the trading account for the Free Margin and whether it is sufficient to open the position:

a) the “New Margin” for the Client’s aggregate position is calculated: for locked positions depending on the hedged margin; for other positions, depending on the initial margin, which is calculated by the weighted average price (by the volume) of all positions, except for the locked ones;

b) if the pending order level falls into a price gap, the floating profit/loss for all open positions and new positions is calculated at the current prices available at the moment when the order was placed in the queue to be executed;

c) «Free margin» is calculated by the formula: Free margin = Balance — New margin + Floating profit / Floating loss;

d) If the above calculations are made and the «Free margin» for the new position is less than zero, the Company has the right to decline the request to open the position and delete the Pending Order. The cancellation will be accompanied by a corresponding «No money» entry in the Server Log File. In any case, the Company seeks to execute such orders at the best available prices through the Company’s liquidity providers.

6.24 An order is deemed executed once the corresponding record appears in the Server Log File.

6.25 Once the order is executed, a corresponding record appears in the Server Log FIle, and the position opened with a pending order will be assigned with the same ticket as the pending order.

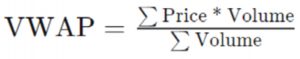

6.26 In the event that liquidity from liquidity providers is insufficient to execute an order fully, the order may be executed at the volume-weighted average price (VWAP), i.e., the best available price at the moment of execution. The volume-weighted average price (VWAP) is calculated by the formula:

For example, you opened a position of 3.3 lots in EUR/USD, and the counterparty can supply liquidity in the following proportion:

1.00 EUR/USD at the rate of 1.48354

1.50 EUR/USD at the rate of 1.48349

0.80 EUR/USD at the rate of 1.48319

In this case, the volume-weighted average price is calculated as follows:

VWAP= (1.00 * 1.48354 + 1.50 * 1.48349 + 0.80 * 1.48319) / (1.00 + 1.50 + 0.80) = 1.4834324

6.27 «Buy stop», «Buy limit», «Sell stop», «Sell limit», «Stop loss» and «Take profit» orders are activated at the market price, with the exception of the cases when market conditions are recognized by the Company and the Client as force majeure.

6.28 In the event of a price gap, all orders with activation prices within the gap including pending orders will be executed at the first prices available after the price gap at the moment of execution. The price at which the order is executed may differ from the order level.

6.29 Orders executed at the price set in the order (in the event of a price gap) may be modified and executed at the first prices available after the price gap.

6.30 On some trading instruments, pending orders with simultaneously broken activation and “Take profit” levels are canceled with a “Canceled / gap” record in the comments. Pending orders with simultaneously broken activation and “Stop loss” levels are activated at the first quote available after the price gap and marked with “Started / gap” in the comments, while “Stop loss” is not reset to zero.

6.31 In the event of insufficient liquidity at the order level, the Company may execute «Buy stop», «Buy limit», «Sell stop», «Sell limit», «Take profit» and «Stop loss» orders at the volume-weighted average price, i.e. the best available price at the moment of execution. The Client agrees that the execution price may differ from the order level.

7. Stop Out

7.1 The Company is entitled to involuntarily close the Client’s open positions without the consent of the Client or any prior notice if the equity-to-margin ratio on the trading account is less than the Stop Out level. The Stop Out level is indicated in the “Trading Instruments” section on the Company’s Website.

7.2 The Margin Level is monitored by the Server, which, if all the execution conditions specified in clause 7.1 are fulfilled, will generate a request:

a) for a forced closure of a position on Standard Market, Standard, Fixed or Crypto accounts without prior notice. The Stop Out is executed at the market price, orders are taken from the queue and executed in accordance with the clients’ requests. The Client agrees that the price at which the order is executed may be different from the quote at which the Stop Out request was generated. An involuntary close of a position is accompanied by a corresponding record in the Server Log File and is marked as “Stop Out” (SO).

b) for a forced closure of a position on ECN accounts without prior notice. When the Stop Out level is reached, the positions will be closed one by one starting with the most unprofitable (with the highest floating loss) and executed at the market price until the Equity becomes higher than the Stop Out level.

The Client agrees that the price at which the order is executed may be different from the quote at which the Stop Out request was generated. An involuntary close of a position is accompanied by a corresponding record in the Server Log File and is marked as “Stop Out” (SO).

7.3 The Company guarantees that forced closure of positions (stop out) will not result in a negative balance in the Client’s trading account. However, technically it is possible. Should the execution of Stop Out result in negative equity in the Client’s trading account, the Company shall be obliged to compensate the Client by bringing the Client’s account balance to zero. If the Company suspects the Client of malicious activity intended to abuse negative balance protection on one or several accounts (for example, places opposite positions in the same trading instrument and leaves them open over the weekend or between trading sessions) and has direct or circumstantial evidence that the Client operates two or more accounts under different names, using different registration data, the Company reserves the right to cover the losses exceeding the balance of one account out of the funds of another account, belonging In addition, if the Company has direct or circumstantial evidence that the Client deliberately uses negative balance protection for malicious purposes, the Client shall be fully responsible for the loss and undertakes to immediately pay the full amount of any such loss.

7.4 In the event that the Company suspects malicious use of negative balance protection on accounts of one or several clients, for example, opposite positions are placed in the same trading instrument and remain open on weekends, during news releases or breaks between trading sessions, the Company has the right to write off all profits received from such transactions.

7.5 The Company is entitled to forcefully close any open positions of the Client without any prior notice in the process of dispute resolution.

7.6 Should any of the instruments be removed from the list of trading instrument, after the release of a corresponding news on the Company’s website, the Company reserves the right to cancel all pending orders and forcefully close all open positions of the Client (if any) placed for the instrument no longer provided by the Company by subsequent notification to the Client.

8. Communication and confidentiality

8.1 In order to communicate with the Client, the Company shall use the following means of communication to confirm money transfers, trading operations’ details, terms and conditions and etc.

8.1.1 Communication channels (information exchange Client-Company/Company-Client):

– the trading platform internal mailing system;

– corporate email;

– telephone;

– information and announcements in the “News” section on the Company’s website;

– feedback form on the Company’s website.

8.1.2 Information channels (receiving updated information by the Client/Company in a one-way fashion):

– Company website;

– SMS.

8.1.3 Operating channels (performing actions by the Client/Company ):

– trading platform (trading operations);

– telephone (trading operations);

– Personal Area on the Company’s website (non-trading operations).

8.2 In order to obtain access codes (login and password) to the Personal Area, the Client shall complete the registration in the special section of the Company’s website, providing personal information necessary for his unambiguous identification (last name, first name, middle name (if any), mobile phone number, email). When the registration is complete, the Client shall be assigned a unique client ID in the Personal Area, which allows the Client to open his personal trading account. Access codes to the Personal Area are generated and provided to the Client when opening a trading account.

8.3 The Company shall rely on the information provided by the Client during the registration and in the Personal Area, and shall not bear any responsibility for the accuracy of the provided information. The Client is solely responsible for the accuracy and validity of the information provided to the Company, as well as for all possible consequences caused by their inaccuracy and / or invalidity.

8.4 For security reasons and for fraud prevention, the Company may require a passport or other documents to confirm the Client’s identity and / or trading account operations. In this case, the Client is obliged to submit all the necessary documents at the request of the Company. The Company is entitled to suspend the provision of services to the Client until the necessary documents are received.

8.5 The Company undertakes not to disclose any information about the Client’s operations, accounts and requisites to the third parties, except for cases when partial disclosure of such information is expressly authorized by the Client and is also required by the applicable law.

8.6 The Сlient undertakes not to disclose any information that may become available to him regarding the implementation of these Regulations to third parties without the prior written consent of the Company.

8.7 For security reasons, in cases when the Company asks the Client to provide information considered as strictly confidential (the Client’s identity data, security passwords, access passwords), the Client shall provide such information only to an authorized employee of the Company, exclusively in the requested by the authorized employee manner and via the recommended communication channel. Otherwise, the Company shall not be held liable for the safety of confidential information provided by the Client.

8.8 The Client undertakes not to disclose the access codes provided by the Company to third parties.

8.9 In order to ensure security in the event that the Client loses the access codes to his Personal Account or the Trading platform, the Client is obliged to immediately notify the Company by any means possible. Once the Company receives the notification from the Client, it automatically generates new access codes and sends them to the Client’s email address provided during the registration. The Company shall not assume any responsibility for the consequences associated with the loss of access codes by the Client until the new access codes are generated.

8.10 Any messages, notifications or information sent to the Client shall be deemed received:

– one hour after emailing if sent by email;

– immediately after sending, if sent by the trading platform internal mailing system;

– once the telephone conversation is finished, if the communication occurred by phone;

– within 3 hours after the publication, if posted on the company’s website.

8.11 The Client acknowledges that any telephone conversation between the Client and the Company may be recorded and will remain the sole property of the Company and constitute evidence of the Client’s words and requests.

8.12 The client undertakes to keep secret the access codes to the Personal Area and the Trading platform. Each of the Parties is responsible for ensuring that only authorized persons have access to the technical means of communication which ensure the exchange of messages. The Parties shall not refer to non-compliance with this condition when challenging the validity of executed transactions.

8.13 All messages transmitted to the Company using the password and Client code shall be deemed transmitted personally by the Client.

9. Dispute Resolution Procedure

Complaint procedure

9.1 All disputes and differences between the Company and the Client regarding the execution and settlement of foreign exchange transactions and other actions provided for by the Customer Agreement and these Regulations shall be resolved through negotiations, and if no agreement is reached, through the Financial Commission, an external dispute resolution body, or in a judicial proceeding in compliance with the dispute resolution procedure.

9.2 All client complaints shall be accepted by the Company in writing and must be sent via email to dealer@amarkets.com. All complaints filed through any other method (forum, telephone, fax etc.) will not be taken into consideration.

9.3 A complaint must include: the Client’s name and last name, the Client’s login to the trading terminal, the date and time of the complaint’s origin (trading platform time), tickets of all disputed positions and/or pending orders, the description of the dispute with the reference to the clause/clauses of these Regulations, the Client reasonably believes was/were breached by the Company.

9.4 The complaint must not include: an emotional description/appraisal of the dispute, offensive language or threats.

9.5 The Dealer shall have the right to reject a complaint if any of clauses 9.2, 9.3, 9.4 has been breached.

9.6 Complaints shall be accepted by the Company within three business days of the dispute arising. The Client accepts and agrees that the Company shall have the right to reject the complaint in the event of a late submission.

All complaints will be considered within five business days of receipt. In some cases, the consideration period may be extended.

9.7 In the event of a disputed claim, depending on the nature of the dispute, the Company reserves the right to block, fully or partially, the operations on the Client’s accounts until such time as the disputed claim is resolved, or until the Parties reach an interim agreement.

Server Log File

9.8 The Server Log File shall be the main source of information in case of any dispute. Information from the Server Log File has an absolute priority over all other arguments in consideration of any dispute, including the information from the Client Terminal Log File, as it doesn’t record every stage of execution of the Client requests.

9.9 The absence of a relevant record in the Server Log File supporting the Client’s grounds for the complaint, an argument based on the existence of such a record shall be considered invalid.

Liability of the Parties and Indemnification

9.10 The Company may resolve the disputes by:

a) crediting/debiting compensation to/from the Client’s trading account, accompanied by a corresponding record;

b) reopening of erroneously closed positions;

c) deleting erroneously opened positions or placed orders.

Dispute resolution shall be at the sole discretion of the Company, which in each case shall have the right to choose one of the above mentioned methods. Disputes which are not covered by these Regulations shall be resolved in accordance with the common market practice and the Company’s judgment on a fair settlement of a dispute.

In the event of interruptions in the quotes flow due to software or hardware failure, all disputes shall be considered based on synchronized quotes in accordance with clause 2.23 of these Regulations.

9.11 If the Client intended to perform an action/operation, but for some reason he didn’t, the Company shall not indemnify the Client for any potential profit or losses incurred as a result of this inaction.

9.12 The Company does not reimburse the Client for any consequential loss or intangible damages (including emotional distress, etc.).

9.13 The Client shall be liable for any losses incurred by the Company through the Client’s fault, including damages caused as a result of the Client’s failure to provide the documents, required by the Company in accordance with its Regulatory documents, as well as losses incurred as a result of any false or distorted information contained in the documents submitted by the Client.

9.14 The Company shall not be liable for the Client’s losses if such losses resulted from cyber attacks, network, power grid and/or telecommunications system failures, that are used to negotiate the essential terms of conversion transactions or to ensure other operations of the Company and occurred through no fault of the Company.

9.15 The Company shall not be liable for the unauthorized use of the Client’s identification data by third parties.

9.16 The Company shall not be liable for the results of trading operations, performed by the Client based on the analytical materials provided by the Company. The Client is informed and understands that performing trading operations carries a high level of risk, which may result in the full or partial loss of capital.

9.17 Neither Party shall be liable for delay or failure to fulfill obligations caused by the unforeseen circumstances (force majeure) beyond the Parties’ control, i.e. war, whether declared or not, civil unrest, fires and other natural disasters.

9.18 The Party to whom it becomes impossible to meet its obligations undertakes to notify the other party of the commencement and cessation of the above mentioned circumstances within 2 (two) days. Should one of the parties fail to notify the other party of force-majeure circumstances in due time then it shall be deprived of the right to refer to them in future as the grounds preventing the fulfillment of their obligations.

9.19 If such circumstances or their consequences last more than one month, the Parties shall negotiate and reach a consensus regarding further fulfillment of the obligations under these Regulations and their survival.

9.20 The Company shall settle all disputes in accordance with clauses 9.10 (a), (b) and / or (c) immediately after the decision is made, but not later than one business day.

9.21 In the event of a non-market quote entering the trading stream, the Company shall be liable to the Client for any losses incurred due to the non-market quote. The Company reserves the right to either compensate for such losses or to cancel the trading results and restore positions. Any profit gained from the non-market quote will be fully debited from the Client’s account.

A non-market quote is defined as a price on the trading platform that meets all of the following criteria:

- A significant difference from the current market price.

- A sudden and large price gap.

- A quick return to the original price, leaving a price gap behind.

- No rapid price movements leading up to the quote.

- There are no major economic news or events significantly impacting the instrument.

9.22 In the event of an erroneous closure of a position by the Dealer when the position is closed without the participation of the Client, the Company undertakes by the written request from the Client to either restore the initial position of the Client or leave the position closed without performing any modifications. The Company does not reimburse the Client for any potential or floating profit during this incident.

9.23 In the event that trading operations at other than market prices are detected as a result of a software failure, as well as any transactions involving attempts to hack a trading terminal and / or trading server and take an unfair advantage of such actions for personal gain, the Company reserves the right to reinforce various sanctions, including the cancellation/deduction of illegally obtained profits and closure of the Client’s trading account.

The client acknowledges that in any case no claims shall be accepted regarding the failure to manage/modify a position in the period when the Company reviewing this disputable situation and taking measures to resolve it.

The Client acknowledges that the Company has the right not to notify the Client additionally that the disputed situation has been settled and the order executed, and the Client assumes responsibility for all the inherent risks.

Rejection of Complaint

9.24 No complaints filed in respect of any unexecuted orders/requests sent during the routine maintenance on the Server shall be accepted, if the Client has been notified of such maintenance in advance by trading platform internal mailing system or via any other communication channel. The fact that the Client did not receive the notification shall not constitute grounds for complaint.

9.25 No complaints concerning order execution time shall be accepted, provided that all conditions of clause 6.23 have been satisfied, regardless of how long the Company took to execute the order and how long it took before the corresponding record of order execution appeared in the Server Log File.

9.26 Client complaints shall not be accepted with regard to the cancellation of financial results from transactions performed using the excess Free Margin on the trading account gained as a result of a profitable trade (subsequently cancelled by the Company) opened at a spike or at a quote received as a result of a manifest error on the part of the Company.

9.27 When reviewing the dispute, the Company shall not take into consideration any references made by the Client to quotes of other companies or informational systems.

9.28 Both the Client and the Company are entitled to initiate the dispute resolution process in accordance with these Regulations.

10. Terms and definitions

10.1 In the event of ambiguity in the interpretation of the terms described in this document, one should be guided by the terms, defined primarily in the Customer Agreement, and secondarily in other regulatory documents of the Company.

10.2 In these Regulations:

«Ask» — the price at which the Client may buy the currency (the higher price in a quote).

«Buy limit» — pending order to buy the currency at a price lower than the price at the moment the order was placed. The order will be placed if the current price to open a long position reaches the price specified by the order.

«Buy stop» — pending order to buy the currency at a price higher than the price at the time the order was placed. The position will be opened if the price reaches the order’s price.

«Balance» — the total amount of funds, available in the Client’s trading account, excluding open positions.

“Bar (candle)”– an element of a price chart that shows the opening and closing prices, as well as the lowest and highest prices for a particular period of time (for example, 1 minute, 5 minutes, one day, one week).

«Bid (Sell price)» — the price at which the Client may sell (the lower price in a quote).

«Volatility» — price volatility, fluctuations. High volatility is a characteristic that describes the market that is prone to sudden fluctuations over a short period of time.

«Dealer» — the employee of the company who is authorized to process requests and orders from Clients to perform trading operations.

«Company» — the server or the employee of the Company who is authorized to execute and process Client requests, orders and Stop outs.

«Quoting» — a stream of quotations provided to the trader to perform trading operations.

«Quote» — the price of one currency in the financial instrument quoted in terms of another (Bid/Ask).

«Client» — an individual person, who entered into the Customer Agreement with the Company and uses its services to perform trading operations on the terms of margin trading.

«Customer Agreement» — the Agreement between the Client and the Company, which together with other Regulations and Risk warning, is defined as the “Current Agreement” and governs all conditions pertaining to the Company’s relationships with the Client.

«Liquidity» – refers to how to easily one can sell or buy a financial asset at a market price. High liquidity implies high activity and trading volume.

«Client Terminal log-file» — the file, created by the Client Terminal which records accurately to the second all requests and orders sent by the Client to the Company.

«Server log-file» — the file created by the server which records accurately to the second all requests and orders sent by the Client to the Company and their results.

«Locked positions» — long and short positions of the same size opened for the same financial instrument on the same trading account.

«Lot» — the standard amount of the base currency in respect of which the conversion transaction is concluded. A transaction may have a volume of several lots or part of a lot.

«Margin» — client funds, required by the broker to maintain open positions.

«Instant execution» — the mechanism providing quotes to the Client in real time, so that the Client could perform a transaction at any moment at the prices he sees in the trading platform.

«Normal Market Conditions» — shall mean the following market conditions: quoted prices are displayed in the trading platform without interruptions; the stream of quotes is steady with low volatility and the absence of large price gaps.

«Trading hours» — is a time interval from 00:00 Monday to 23:00 Friday EET, except on holidays. Relevant information about the trading hours and holidays is published on the Company’s website.

«Pending order» — a request from the Client to the Company to open a position once the price has reached the level of the order.

«Market Opening» — the time when the market opens after weekends, holidays or time gaps between trading session.

«Liquidity Provider» — a bank or ECN (Electronic Communications Network) which provides the streaming quotes to the Company. May also be used to hedge Client trades.

«Pip» — the smallest price movement made by any exchange rate.

«Market execution» — the type of execution of Client request. The market order guarantees execution but does not guarantee a particular price. The quotes are indicative, and the actual execution price of an order may differ to a greater or lesser extent from the current quotation at the time the order is filled.

«Swap» — the rollover of a position to the next day (a table with swap values is available on the Company’s website).

«Expert Advisor» — an algorithm used to manage a trading account in the form of a program based on a special language, which sends orders and requests to the server via the Client Terminal.

«Market snapshot» — the stream of quotes for the instruments at a particular period of time.

«Ticket» — the unique identification number assigned to each open position, Pending Order, deposit/ withdrawal transaction in the trading platform.

«Price gap» at the market opening — shall mean any of the following:a) the current session’s first Bid quote is higher than the last Ask of the previous session;b) the current session’s first Ask quote is lower than the last Bid quote of the previous session.

«Stop&Limit Level» — the price corridor (in points) from the current market price, within which it is forbidden to place Stop and Limit orders, as well as pending orders. When significant economic news is released, the Stop & Limit level can be increased.

«Manifest error» — the opening/closing of the Client’s position by the Company or the execution of his order, at a price which significantly differs from the stream of quotes at the actual moment of execution, or any other action or lack of action from the Company due to action or inactivity of the Company, associated with a clearly erroneous determination of the price levels at a particular point of time.

«GTC (Good till cancelled)» — an order that is valid until the Client sends a request to delete the order. «If done order» — shall have the meaning given in clause 6.2.

«Sell limit» — shall have the meaning given in clause 6.1.

«Sell stop» — shall have the meaning given in clause 6.1.

«Stop loss» — shall have the meaning given in clause 6.2.

«Stop out» — an order to close one or more open positions (without the consent of the Client or any prior notice) due to insufficient funds required for maintaining open positions.

«Take profit» — shall have the meaning given in clause 6.2.

«Trailing stop» — shall mean the following:

1) a Trailing Stop value set by the Client;

2) the following algorithm for managing “Stop Loss” orders:

a) if an open position’s profit is less than the Trailing Stop value, no action shall be taken;

b) if an open position’s profit exceeds the value of the Trailing Stop, the Client Terminal sends an order to the Server to adjust the Trailing Stop to a new, higher level at the same relative distance to the new price as before;

c) once a new quote has been received that exceeds the value of the distance between the Trailing Stop and the Stop Loss order level, the Client Terminal sends an instruction to the Server to adjust the Stop Loss order to the level that is at the same range from the current price as the “Trailing Stop” value.

A Trailing Stop is only executed when the Client Terminal is online and successfully authorized and connected to the Server.

info@amarkets.com

Date of Last Revision 02/10/2024

AMarkets LLC registered in the Cook Islands with registration number LLC14486/2023